child tax credit payments continue in 2022

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Those returns would have information like income filing status and how many children.

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

In 2022 the tax credit could be refundable up to 1500 a rise from.

. Right now the extra credit is set to begin in July and end in 2022 but on Wednesday Biden said he hopes to extend it at least through the end of 2025 Families who. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. An expanded child tax credit would continue for another year.

19 2022 Published 1232 pm. The advance child tax credit payments were based on 2019 or 2020 tax returns on file. Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The benefit for the 2021 year is 3000 and 3600 for children under.

As part of a COVID relief bill Democrats increased the tax credit to 3000 per child ages 6-17 and 3600. 15 Democratic leaders in Congress are working to. The bill signed into law by President Joe Biden increased the Child Tax Credit from 2000 to up to 3600 and allowed families the option to receive 50 of their 2021 child.

Now even before those monthly child tax credit advances run out the final two payments come on Nov. ET Parents of children age 17 and under got a 1000 bump in their child tax credit for 2021 half of which was paid in monthly installments. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children. Heres an overview of what to know.

The advance child tax credit payments were based on 2019 or 2020 tax returns on file. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400. Those returns would have information like income filing status and how many children.

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

Child Tax Credit 2022 Latest You May Have Missed Crucial Irs Letter How To Get 6 728 Refund Even After The Deadline The Us Sun

How Monthly Child Tax Credit Checks May Be Renewed By Congress

Will Child Tax Credit Payments Be Extended In 2022 Money

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Opinion Robert E Rubin And Jacob J Lew A Plan To Help Kids Without Increasing Inflation The New York Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/22957800/1235261204.jpg)

Child Tax Credit Extension Democrats May Lose Their Best Weapon Against Child Poverty Vox

Monthly Child Tax Credit Payments Have Ended And Their Future Is Unclear

Food Insufficiency In Families With Children Increased After Expiration Of Child Tax Credit Monthly Payments Children S Healthwatch

Child Tax Credit Will Monthly Payments Continue In 2022 11alive Com

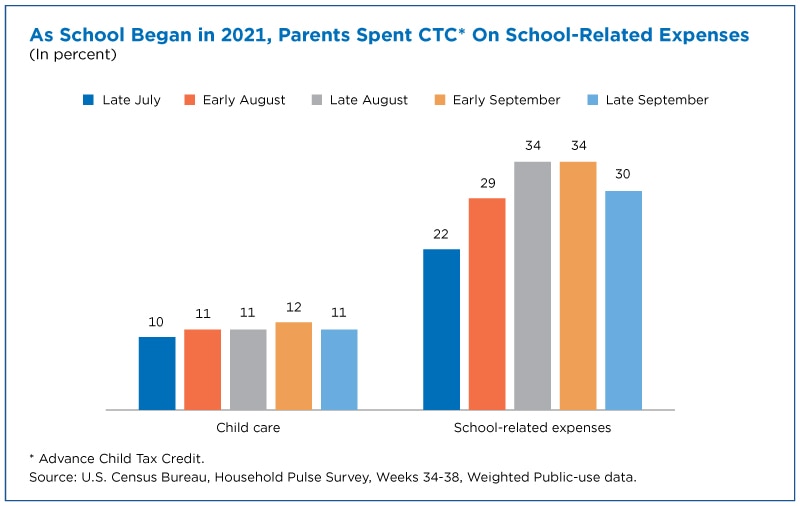

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

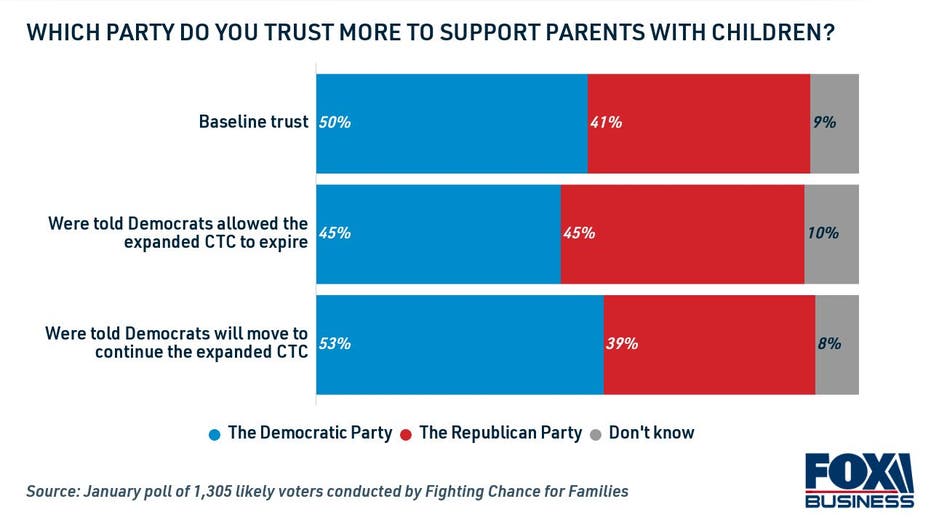

Expiration Of Child Tax Credit Payments Reflects Poorly On Democrats Poll Says Fox Business

Child Tax Credit Here S What To Know For 2022 Bankrate

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

Will Monthly Child Tax Credit Payments Continue Into 2022 Whas11 Com

Final Child Tax Credit 2021 Hit Bank Accounts Will There Be More

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep